Navigating the complexities of car insurance can be daunting, especially as we age. This comprehensive guide explores affordable car insurance options tailored specifically for seniors, considering their unique needs and circumstances. We’ll delve into various factors impacting premiums, from driving habits to potential health conditions.

Understanding the diverse range of insurance providers and their specific coverage plans for seniors is crucial. This guide will equip you with the knowledge to make informed decisions and secure the best possible coverage at a price that fits your budget.

Affordable Car Insurance Options for Seniors

Finding affordable car insurance can be a challenge for seniors, but understanding your options and needs can make the process easier. This article explores various aspects of securing suitable coverage, from understanding senior-specific needs to comparing insurance quotes and navigating discounts. It also provides a framework for maintaining your policy and addressing potential issues.

Understanding Senior Needs

Seniors often face unique financial and driving situations that impact insurance premiums. Financial considerations include fixed incomes, potential healthcare costs, and the need to prioritize essential expenses.

- Financial Considerations: Seniors may have limited disposable income, making affordable premiums a priority. Budgeting for insurance alongside other expenses is crucial. Potential future healthcare costs may also factor into the financial equation.

- Driving Habits and Needs: Seniors often drive shorter distances and at a slower pace. Their driving habits and needs may differ from younger drivers. Familiarity with the local area and frequent routes might also influence the insurance cost.

- Potential Health Conditions: Pre-existing health conditions can impact insurance premiums. While insurance companies can’t discriminate based on health, certain conditions may affect the level of coverage required or the cost of insurance.

| Discount Type | Description |

|---|---|

| Defensive Driving Courses | Completing a course demonstrates safe driving practices. |

| Multiple Vehicles | Having multiple vehicles with the same insurance company can often lead to savings. |

| Good Student Discount | Applies if a senior is a student or enrolled in a driving course. |

| Accident-Free Driving History | A history of no accidents often leads to lower premiums. |

Types of Affordable Insurance Options

Numerous insurance companies offer plans tailored for seniors. Choosing the right company depends on specific needs and coverage requirements.

- Insurance Companies: Companies like State Farm, Geico, Progressive, and Allstate are known for competitive pricing. Independent agents can also offer options from various providers.

- Coverage Options: Compare the comprehensive, collision, liability, and uninsured/underinsured motorist coverage options available from different providers. Coverage levels and limits will vary.

| Insurance Company | Deductible | Premium (Example) |

|---|---|---|

| State Farm | $500 | $1200/year |

| Geico | $1000 | $1000/year |

| Progressive | $250 | $1500/year |

Comparing Insurance Quotes

Obtaining multiple quotes is essential to find the best deal. Comparing quotes and coverage can be time-consuming, but it’s worthwhile to save money.

- Obtaining Quotes: Use online comparison tools, contact multiple insurance providers directly, or work with an independent agent.

- Comparing Quotes: Carefully compare deductibles, premiums, coverage limits, and policy exclusions. Don’t solely focus on the lowest premium.

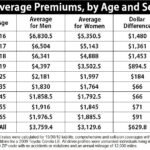

Factors Affecting Premiums

Driving history, vehicle type, location, and driving frequency all influence insurance costs.

- Driving History and Accident Records: A clean driving record is crucial for lower premiums. Past accidents or violations can significantly increase premiums.

- Vehicle Type and Safety Features: Vehicles with advanced safety features often come with lower premiums.

- Location and Driving Frequency: High-risk areas or frequent driving can affect insurance costs.

| Factor | Impact on Premium |

|---|---|

| Accident-free driving history | Lower premium |

| High-theft area | Higher premium |

| Luxury vehicles | Potentially higher premium |

Discounts and Financial Assistance

Source: forbes.com

Various discounts are available for seniors, along with potential government programs for affordable coverage.

- Common Discounts: Loyalty programs, good student discounts, and multi-vehicle discounts can help reduce premiums.

- Government Programs: Some states offer financial assistance programs to help seniors afford insurance.

Maintaining Coverage and Policy Updates

Regular policy reviews and updates are essential to maintain coverage and avoid potential issues.

- Policy Reviews: Review your policy regularly to ensure it still meets your needs.

- Updating Information: Keep your personal information and address up-to-date.

Illustrative Scenarios

A senior with a clean driving record, a small sedan, and residing in a low-crime area may have a lower premium than someone with a history of accidents, a larger SUV, and living in a high-theft region. This highlights the variety of factors that affect insurance costs.