Affordable car insurance options for seniors are crucial for maintaining mobility and financial well-being. This comprehensive guide explores the unique needs of senior drivers, comparing insurance options and highlighting discounts tailored to this demographic. Navigating the complexities of insurance can be challenging, but this resource simplifies the process, providing a clear overview of coverage types, cost factors, and application procedures.

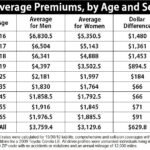

Understanding the specific factors impacting insurance premiums for seniors is essential. This article details common influences, such as driving history and experience, and explains how these factors are considered by various insurance providers. Furthermore, it examines the various discounts and benefits available to senior drivers, offering insights into maximizing savings.

Affordable Car Insurance Options for Seniors

Securing affordable car insurance can be a challenge for seniors, but it’s a crucial aspect of maintaining independence and financial security. This guide explores various factors influencing insurance costs for seniors, Artikels available options, and provides strategies for minimizing premiums.

Overview of Senior-Specific Insurance Needs

Insurance premiums are often influenced by factors like age, driving history, and the type of vehicle. Seniors, due to their often-reduced driving frequency and experience, may face different insurance needs than younger drivers. This section details common factors influencing senior insurance costs and highlights potential discounts.

- Age and Driving Habits: Seniors often drive less frequently and at slower speeds, which can lead to lower risk profiles for insurance companies. Driving experience, including any recent accidents or violations, plays a significant role in determining premiums.

- Vehicle Type and Usage: The type of vehicle, its value, and how it’s used affect insurance costs. A classic car or a luxury vehicle may have a higher premium than a basic model. If the vehicle is primarily used for short trips, insurance rates might be lower.

- Coverage Needs: Seniors may have different coverage needs compared to younger drivers. Liability coverage might be a primary concern, and comprehensive or collision coverage might be tailored to their specific needs and vehicle value.

- Discounts for Seniors: Many insurance companies offer discounts based on age and driving history. Examples include good driver discounts, safe driver discounts, and discounts for seniors who maintain a clean driving record.

- Examples of Insurers: Many insurance companies cater to seniors, offering specialized plans and competitive rates. Examples include [Insert examples of insurance companies].

| Age Group | Estimated Premium (USD) |

|---|---|

| 18-25 | $1,800 |

| 26-40 | $1,500 |

| 41-55 | $1,300 |

| 56-70 | $1,200 |

| 71+ | $1,100 |

Identifying Affordable Options

Several factors influence the affordability of car insurance for seniors. This section examines different types of plans and how driving history affects costs.

- Types of Plans: Different plans offer various levels of coverage. Seniors should carefully consider their needs and choose a plan that balances coverage and cost.

- Insurance Providers: Comparing providers based on their pricing strategies for senior drivers is essential. Some insurers offer special rates or discounts.

- Driving History: A clean driving record with no accidents or violations often results in lower premiums. Previous accidents or traffic violations will increase costs.

Specific Discounts and Benefits for Seniors

Numerous discounts are available for senior drivers. This section Artikels common discounts and how they impact premiums.

- Good Driver Discounts: A clean driving record can often lead to significant discounts.

- Safe Driver Discounts: Insurance companies may reward safe driving habits through discounts. These may include discounts for using telematics devices or participating in safe driving courses.

Insurance Policies and Coverage Options

Source: tgsinsurance.com

Understanding various coverage options is crucial for seniors. This section explains different types and their implications.

- Liability Coverage: Covers damages to other people or their property if you’re at fault.

- Collision Coverage: Covers damages to your vehicle in an accident, regardless of who’s at fault.

- Comprehensive Coverage: Covers damages to your vehicle from incidents other than accidents, such as vandalism, theft, or weather events.

Navigating the Insurance Application Process

Applying for insurance as a senior can be straightforward. This section provides a guide for applying online.

- Gather necessary documents (driver’s license, vehicle information, etc.).

- Compare quotes from different insurers.

- Complete the online application form.

- Submit required documentation.

- Review the policy details carefully.

Tips for Saving Money on Insurance

Implementing these strategies can help seniors reduce insurance premiums.

- Maintain a clean driving record.

- Consider safe driving courses.

- Compare quotes from different insurance providers.

Resources and Further Information

This section provides resources for further information about senior insurance.

- [List reputable websites and organizations providing senior insurance information]

- [List contact information for senior-focused insurance providers]