Securing the right insurance for your prized classic or antique vehicle is crucial. These vehicles often hold significant sentimental and financial value, demanding specialized coverage beyond standard policies. This guide explores the intricacies of car insurance policies tailored for these unique automobiles, providing insights into coverage options, premium factors, and claim procedures.

Understanding the specific needs of classic and antique vehicles is key. From the impact of age and condition on premiums to the nuanced differences between various coverage types, this comprehensive resource will equip you with the knowledge to make informed decisions when choosing an insurance policy. This will ensure your treasured vehicle is protected against unforeseen events.

Car Insurance Policies for Classic or Antique Vehicles

Owning a classic or antique vehicle often comes with a unique set of insurance considerations. These vehicles, valued for their historical significance and often requiring specialized maintenance, necessitate insurance policies that address their specific needs. This guide provides a comprehensive overview of the intricacies of insuring classic and antique automobiles.

Overview of Classic/Antique Car Insurance

Source: scsai.com

Classic and antique car insurance differs significantly from standard auto insurance. The unique needs stem from the vehicles’ age, rarity, and often-limited production numbers, which affect the risk assessment and coverage requirements. Standard policies typically exclude or limit coverage for classic vehicles, often due to the higher risk of theft or damage.

- Unique Insurance Needs: Classic and antique vehicles require insurance tailored to their specific characteristics, such as their historical value and limited availability. This might involve specialized appraisals and coverage for restoration or repair.

- Distinguishing Factors: Standard car insurance focuses on everyday usage and repair costs. Classic car insurance, however, typically emphasizes the vehicle’s historical value and the potential for high restoration costs. It may involve a valuation process beyond the standard market value.

- Coverage Limitations/Exclusions: Policies might exclude damage caused by wear and tear, normal aging, or modifications that increase the risk. Some policies may have specific limitations on coverage for accidents or collisions.

- Policy Types: Comprehensive and collision coverages are common, but the specific terms and exclusions are often adjusted to accommodate the unique characteristics of the vehicle. Policies might also include options for agreed-value or stated-value coverage, ensuring a fair settlement in case of total loss.

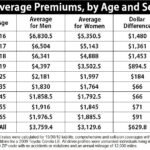

Factors Affecting Policy Premiums

Source: unruhinsurance.com

Several factors influence the cost of classic/antique car insurance. A comprehensive understanding of these factors is crucial for securing the most appropriate and cost-effective coverage.

- Vehicle’s Age, Make, Model, and Condition: Older, rarer models, and vehicles in pristine condition command higher premiums. The risk assessment for restoration and repair are significantly impacted.

- Vehicle’s Value and Historical Significance: Higher valuations often translate to higher premiums, as the potential financial loss is greater. Historical significance might also affect the premium based on the vehicle’s importance in automotive history.

- Usage Frequency: Show cars used infrequently have different insurance needs than daily drivers. The usage pattern and risk of accidents directly impact the premium calculation.

- Maintenance History: A well-maintained vehicle with documented upkeep history presents a lower risk to the insurance company, potentially leading to lower premiums.

- Driver’s Experience and Driving Record: A driver with a clean driving record and significant experience with classic vehicles may qualify for a reduced premium. This factor, as with standard policies, weighs heavily in risk assessment.

Coverage Options and Exclusions

Source: uniquecarsandparts.com

| Coverage Type | Description | Typical Exclusions |

|---|---|---|

| Comprehensive | Covers damage from perils not related to collisions, such as fire, theft, vandalism, weather, or acts of nature. | Damage due to wear and tear, normal aging, modifications increasing risk, neglect, and certain types of weather-related events. |

| Collision | Covers damage resulting from collisions with other vehicles or objects. | Damage due to wear and tear, pre-existing conditions, neglect, or certain types of environmental damage. |

| Uninsured/Underinsured Motorist | Covers damages caused by accidents with drivers lacking or having insufficient insurance. | Damage from accidents involving drivers with valid, but insufficient coverage. |

Specific exclusions will vary between policies. It’s crucial to carefully review the policy document to understand the precise limitations of the coverage.