Navigating the complexities of car insurance can be daunting, especially when considering the variations across different states. This comprehensive guide explores the diverse landscape of state-specific regulations, highlighting the factors that influence insurance premiums and coverage options. From minimum liability requirements to optional add-ons, we’ll delve into the nuances of car insurance policies across the United States.

Understanding these differences is crucial for making informed decisions about your vehicle insurance. This resource aims to equip you with the knowledge needed to compare policies effectively and find the best coverage for your needs, regardless of your location. We’ll cover various aspects, including the legal requirements, types of coverage, and factors affecting premiums, ultimately providing a clear path to finding the right insurance fit for your driving circumstances.

Introduction to State-Specific Car Insurance

Car insurance regulations vary significantly across the United States, impacting both the cost and the types of coverage available. These differences stem from diverse factors, including driving habits, accident rates, demographics, and state-specific legal requirements. Understanding these variations is crucial for anyone purchasing or renewing car insurance across different states.

State Variations in Car Insurance Regulations

The divergence in car insurance regulations arises from varying approaches to safety, financial responsibility, and risk management within each state. For instance, states with higher accident rates might mandate higher minimum coverage limits to ensure adequate compensation for victims. Driving habits, like the prevalence of aggressive driving or specific road conditions, also contribute to the differing insurance standards.

States with younger populations or higher concentrations of new drivers might have more stringent requirements for new driver programs or higher minimum liability coverage to mitigate the risk of accidents. Conversely, states with established populations and lower accident rates might have more lenient standards.

Examples of states with comparatively high insurance premiums include those with high accident rates, dense urban areas, or challenging driving conditions. Conversely, states with lower premiums often have a history of lower accident rates or more favorable driving conditions. These factors, combined with the state’s overall economic situation, influence the cost of car insurance.

Minimum Liability Coverage Requirements

Each state mandates a minimum level of liability coverage, ensuring drivers can financially compensate individuals injured in accidents. These minimums vary considerably across the nation. The specific coverage amounts are crucial to understand when comparing insurance policies across states.

| State | Minimum Bodily Injury Liability (per person) | Minimum Property Damage Liability |

|---|---|---|

| California | $15,000 | $5,000 |

| Florida | $10,000 | $10,000 |

| New York | $25,000 | $25,000 |

| Texas | $30,000 | $25,000 |

| Illinois | $25,000 | $20,000 |

Types of Coverage Variations

Different types of car insurance coverage address various risks and responsibilities. These coverages, such as liability, collision, and comprehensive, are defined and applied differently across states, influencing policy costs and the overall protection afforded to drivers.

Coverage Definitions and Applications

Liability coverage protects policyholders against claims from others involved in accidents they cause. Collision coverage, on the other hand, protects against damage to the insured vehicle, regardless of who is at fault. Comprehensive coverage covers damage to the insured vehicle from events other than collisions, such as vandalism, theft, or natural disasters. Variations in state laws dictate the specific ways these coverages are applied and the extent of protection offered.

Coverage Limits and Optional Add-ons

Source: hgmsites.net

The specific coverage limits offered in different states vary significantly. States with higher accident rates may offer higher coverage limits to ensure adequate compensation for victims. State laws also influence the availability of optional add-on coverages, such as uninsured/underinsured motorist coverage, which is designed to protect drivers from accidents caused by drivers without insurance or with insufficient insurance.

| State | Typical Collision Coverage Limits | Typical Comprehensive Coverage Limits | Uninsured/Underinsured Coverage |

|---|---|---|---|

| Arizona | $100,000 – $500,000 | $100,000 – $500,000 | Required |

| Nevada | $100,000 – $300,000 | $50,000 – $250,000 | Not Required |

| Washington | $100,000 – $250,000 | $50,000 – $100,000 | Required |

Factors Affecting Insurance Premiums by State

Several factors contribute to the variations in car insurance premiums across states. These factors, including driving records, vehicle types, and geographic location, all impact the risk assessment and pricing strategies employed by insurance companies.

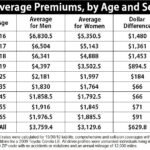

Impact of Driving Records and Vehicle Types

Source: compare.com

Driving records, including accident history and traffic violations, significantly influence insurance premiums. States with higher accident rates generally have higher premiums to reflect the increased risk. The type of vehicle, such as its make, model, and safety features, also plays a role in determining premiums. Insurance companies assess the likelihood of damage or theft to various vehicle types.

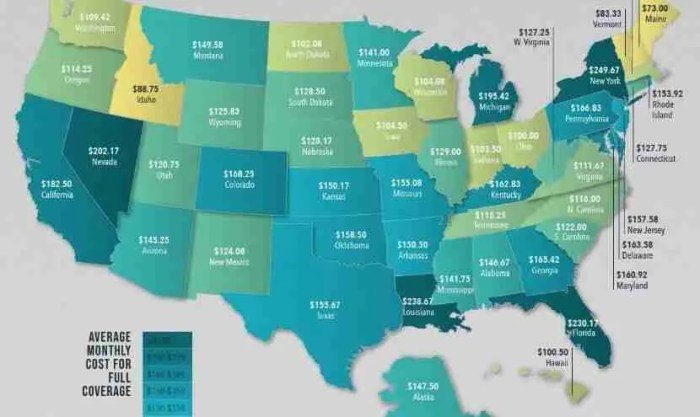

Impact of Accident Rates and Vehicle Safety Features

Source: infographicsarchive.com

Accident rates within a state directly correlate with insurance premiums. States with higher accident frequencies generally have higher premiums to account for the greater risk of claims. The presence of vehicle safety features, such as airbags or anti-theft devices, can influence insurance costs by reducing the risk of accidents or theft.

| State | Average Premium for a Compact Car | Average Premium for a Luxury SUV |

|---|---|---|

| Massachusetts | $1,800 | $2,500 |

| Oregon | $1,500 | $2,200 |