Lowering your car insurance premiums is achievable through adopting safe driving habits. This comprehensive guide explores the crucial link between responsible driving and reduced insurance costs. We’ll delve into practical strategies, from understanding insurance calculation methods to implementing defensive driving techniques.

By understanding the factors that influence insurance premiums, drivers can proactively take steps to improve their driving records and ultimately secure lower premiums. This includes exploring various discounts and incentives available to safe drivers, and evaluating the role of technological advancements in safety and cost savings.

Safe Driving Practices for Lower Insurance Premiums

Maintaining a safe driving record is crucial not only for personal safety but also for securing lower car insurance premiums. Consistent adherence to safe driving practices can significantly reduce your accident risk and consequently, your insurance costs. This section Artikels key safe driving behaviors and their impact on insurance rates.

Safe Driving Behaviors for Lower Premiums

Implementing these safe driving practices can contribute to a lower insurance premium:

- Defensive Driving: Anticipating potential hazards, maintaining a safe following distance, and reacting appropriately to unexpected situations are key components of defensive driving. This proactive approach reduces the likelihood of accidents and their associated costs.

- Avoiding Speeding: Speeding significantly increases the risk of accidents. Maintaining the speed limit not only adheres to traffic laws but also reduces the severity of potential collisions. This demonstrably reduces accident risk and subsequent insurance claim costs.

- Following Traffic Laws: Adherence to all traffic laws, including those concerning lane changes, turn signals, and right-of-way, is essential. Consistent adherence to these rules reduces the chance of violations and accidents.

- Avoiding Distracted Driving: Engaging in any activity that diverts attention from driving, such as using a mobile phone or eating, greatly increases the risk of accidents. Avoiding these distractions significantly reduces accident risk and insurance costs.

- Proper Vehicle Maintenance: Ensuring your vehicle is well-maintained, including proper tire pressure, functioning brakes, and headlights, is crucial. This reduces the likelihood of mechanical failures that can lead to accidents.

Impact of Driving Behaviors on Insurance Rates

Specific driving behaviors directly influence insurance premiums. For example, speeding tickets or accidents demonstrably increase premiums. Conversely, a clean driving record, coupled with adherence to safe practices, typically leads to lower premiums.

Comparison of Safe Driving Techniques and Premium Impact

| Safe Driving Technique | Potential Impact on Insurance Premiums |

|---|---|

| Defensive driving | Potentially lower premiums due to reduced accident risk. |

| Maintaining safe following distance | Potentially lower premiums due to reduced rear-end collisions. |

| Avoiding speeding | Potentially lower premiums due to reduced accident severity and frequency. |

| Avoiding distracted driving | Potentially lower premiums due to reduced accident risk. |

Understanding Insurance Premium Structures

Source: excaliburinsurance.ca

Insurance premiums are not arbitrarily set. A complex calculation determines the cost of your policy, influenced by several factors. Understanding this structure is key to effectively managing your insurance costs.

Factors Influencing Insurance Premiums

Several factors significantly impact your car insurance premiums:

- Driving History: Accidents and violations directly impact your premium. A clean driving record is usually rewarded with lower rates.

- Vehicle Type: The make, model, and year of your vehicle influence its perceived risk and repair costs, affecting premium calculations.

- Location: High-accident areas typically have higher premiums.

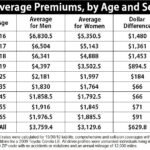

- Age and Gender: Driving experience and risk profiles, sometimes based on age and gender, influence rates.

- Claims History: Past claims, whether minor or major, can increase premiums.

Insurance Company Pricing Models

Different insurance companies employ varying pricing models. Some might prioritize driving history, while others place more emphasis on vehicle type or location. Comparing different company models is crucial for finding the best rates.

Factors Influencing Insurance Premiums and Their Weights

| Factor | Relative Weight (Illustrative) |

|---|---|

| Driving History | High |

| Vehicle Type | Medium |

| Location | Medium |

| Claims History | High |

| Age and Gender | Medium |